How to use Comparison charts?

We recommend reading the first part of this article here.

NEPSE index gives us the average market movement direction, which means some sectors perform better than others. Here we have a concrete example of its use case. Let's compare Life Insurance sector with Hotels and Tourism sector. As the market has started to go down from all time high in August 2021, we were expecting a further downward movement from the temporary rally at around February 2022. The charts below are from mid-February 2022 to mid-February 2023.

The first thing we notice is life insurance is consistently below NEPSE by around 10-12 percent while hotel and tourism stays 10-12 percent above NEPSE.

Secondly, the slope of the chart from March to mid-April 2022, life insurance drops considerably quicker than NEPSE which itself drops at a much higher rate than hotels and tourism sector. At this point of time, we were expecting bearish momentum as per our market gauge. This meant that around end of April we had opportunity to modify our portfolio and put some of our eggs in hotels and tourism sector and remove some part from life insurance sector. This is first sector rotation - diversification. In this way of diversification, we would protect our asset from market volatility.

Moreover, the three bottoms at end of June, mid of October and mid of December paints a slightly different picture too. We can see a deeper move on October and a recovery in December for Life Insurance wheareas, shallower dip in October and recovery with bull flag on December for hotel and tourism sector. All of which suggests that hotel and tourism sector is still outperforming and we expected it to outperform life insurance sector after December.

At the end of December our market gauge flagged buy signal for NEPSE as well as both life insurance & hotel and tourism sector. When we combined this information with other indicators at the time such as RSI divergence, text book triple bottom pattern, Hammer candle followed by high volume upward movement, upward MACD convergence, we expected a strong bullish movement with hotel and tourism sector out performing life insurance. As of the time of writing this article i.e., Feb 8, 2023, we see that hotel sector increased by around 25% wheareas life insurance by around 20%.

Although hotel and tourism sector outperformed life insurance sector (as of Feb 8, 2023) but not as strongly as we expected. This change suggests that in near future, there is a good possibility that life insurance sector will outperform hotel and tourism sector if the market is bullish which we are expecting because our market gauge is still bullish as of today (Feb 8, 2023) but might change. This means that now we have opportunity to move some portion of hotel and tourism stocks to life insurance stocks for better returns. This is second sector rotation - concentration to increase returns.

First-Second Sector Rotation Concrete examples

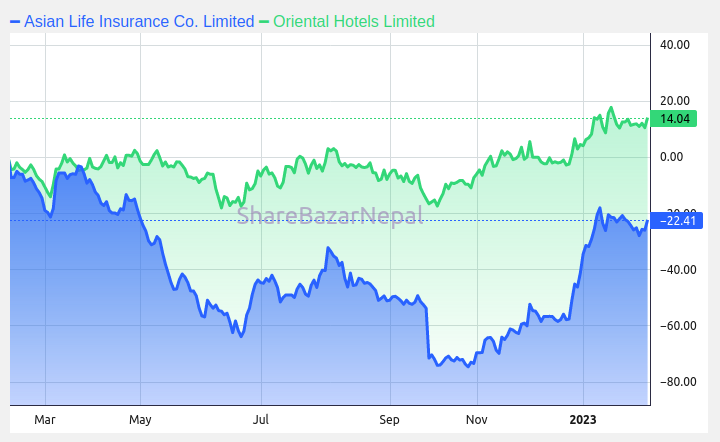

This time we will focus on how we can rotate sectors when one of the sector in increasing more than the others. From our analysis upto Feb 8, in previous paragraphs, we know that life insurace sector dropped sharply compared to hotel and tourism sector at around Feb 2022. Conversely, life insurace sector is rising sharply compared to hotel sector at around end of December 2022 and looks like it will outperform hotel and tourism sector. Armed with this knowledge, we dive into specific security and do their analysis. For example, suppose we have ALICL(Asian Life Insurance) and OHL (Oriental Hotels) in our portfolio. The below chart shows the comparative movement of the two securities.

Exactly as we learned from the sector's comparison charts, ALICL drops rapidly from March to April, which gave us the opportunity to diversify i.e., sell some ALICL and buy OHL to protect agaist higher losses. When we look at the rise in price from Nov-Dec 2022 to Jan 2023, we see a very steep rise in ALICL compared to OHL which is presenting us opportunity for a second sector rotation so that we can concentrate on ALICL for higher returns.

Some common questions

Why not sell and keep NRS instead of sector rotation?

If you look at this case, OHL rose 14% in the bear market when NEPSE is still around -24% (as of Feb 8, 2023). Selling and keeping NRS would not give us that 14% profit. It is all about managing risk and return.

How to know if it is time to sell?

Our market gauge is an excellent tool to identify this timing.